28 Mar How This 16th Century Gunmaker Keeps Reinventing Itself

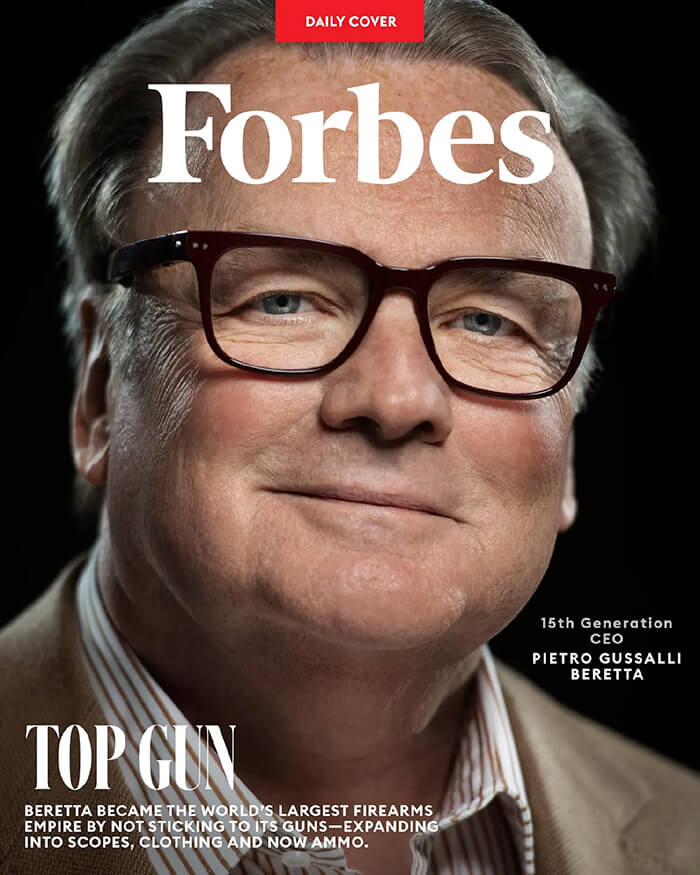

Fourteen generations of the Beretta family sold firearms. Here’s why the head of the 15th is moving beyond, adding bullets, scopes and even clothing.

The October sun is rising over the sprawling, 104-acre grounds of German ammunition producer RWS, on the outskirts of Nuremberg. Far from the 19th-century red brick buildings that house the production facilities, employees outfitted in goggles and earplugs test explosives starting at 7 a.m. chemicalreaction. “We call this our ashtray production,” chuckles StefanRumpler, a former youth Olympic shooter who now works on air rifleammunition for RWS, which churns out more than 3 billioncomponents—including bullets, cartridges and primers (which ignite thepropellant in a cartridge to push the bullet out of the gun)—a year.

One of the leading makers of small caliber ammunition in the world,RWS is now part of Beretta Holding, the company behind the world’soldest gunmaker, Italy-based Beretta. The firm picked up RWS as partof its purchase of Ammotec, Europe’s largest maker of ammunition andpyrotechnics, for an undisclosed sum in 2022.

“This is our biggest acquisition yet,” says Beretta Holding CEO PietroGussalli Beretta, 63, a 15th-generation descendant of the Berettafounders. Since joining the family business four decades ago andbecoming CEO in 1995, Pietro has helped remake the 499-year-old,family-owned company by scooping up firms making everything fromrifles to luxury clothing.

Levon Biss for Forbes

The Ammotec deal, for one, added $600 million to Beretta’s annual sales, helping it overtake Sig Sauer and Smith & Wesson and added several NATO militaries to its roster of customers. Beretta is now the world’s largest firearms company, with $1.7 billion in revenues in 2024.

Speaking from the company’s Luxembourg headquarters, Pietro outlines how that purchase helped the company—long known for shotguns and handguns, like the storied Beretta 92 pistol wielded by customers in the defense sector.

“The three legs of our business are hunters, soldiers and policemen. They need guns, clothing and optics,” he says, referring to scopes and red dot sights designed to improve a firearm’s aim. “The last piece we needed was ammunition. With this latest deal, we finally closed the circle.”

The Beretta family’s wood-paneled private museum in its ancestral home in the town of Gardone Val Trompia in northern Italy houses centuries’ worth of historic guns including some dating back to the late 1400s. BERETTA HOLDING

Before the acquisition, civilian sales accounted for 86% of the company’s revenues, making it dependent on the whims of hunters and gun enthusiasts—particularly in the U.S., the world’s largest firearms market, which makes up 37% of Beretta’s sales. When Covid-19 sent gun sales to American civilians surging, Beretta reaped the rewards, with its North American revenues increasing by 62% from 2019 to 2021.

But Pietro knew that would not last forever. Plus he still had to make up ground for a $580 million U.S. Army contract for handguns that it lost to its rival, New Hampshire-based Sig Sauer, in 2017.

Now, defense and law enforcement sales account for 34% of BerettaHolding’s revenues, up from just 14% four years ago. It’s also a smarttime to bet on the military: Defense spending by European countries hita record $350 billion in 2024 as leaders sought to rearm following theRussian invasion of Ukraine. That’s set to grow even further, afterEuropean Commission President Ursula von der Leyen announced aplan in early March—right after President Trump said the U.S. wouldpause military aid to Ukraine—to provide EU countries with $160billion in loans to invest in their armed forces.

“It’s not just in Europe. Governments all over the world are nowspending more on defense,” says Pietro, pointing to higher sales toMiddle Eastern armies. “Naturally, we’ve benefited from that.”

“You can sell the firearm and then build brand loyalty and sellammunition in perpetuity,” says Mark Smith, an analyst at investmentbank Lake Street Capital Partners, of the benefits of expanding intoammo. “If you’re getting government contracts on [firearms], itprobably opens doors to pick up business on the [ammo] side as well. Itcertainly helps take away some of the ebbs and flows and cyclicality in the business.”

After falling in 2023, Beretta Holding’s EBITDA (earnings beforeinterest, taxes, debt and amortization) rebounded 2% to $245 million in2024—more than triple that of its publicly-traded rivals Sturm, Ruger &Co. and Smith & Wesson. Forbes estimates Beretta Holding, which is100% owned by Pietro, his 87-year-old father

Ugo and his brother billion fortune.

It has definitely not been a get rich quick scenario. Beretta traces its history to 1526, when Bartolomeo Beretta (d. 1565), a rifle barrel maker in the small northern Italian town of Gardone, sold 185 arquebus barrels

—a handheld long gun and a forerunner to the modern rifle—to the Republic of Venice. Generations of Bartolomeo’s heirs have continued the family tradition, still living in Gardone and still making guns. The family-owned business has supplied firearms, including eventually the world’s first semi-automatic pistols and one of the first machine guns, for every European war since 1650.

Under Ugo’s leadership, the firm moved into the U.S. in 1978 and by 1985 had won a coveted contract to provide handguns to the U.S. Army. That’s when Pietro joined the firm, helping his father buy out Beretta’s then minority shareholder, French firearms firm FN Herstal (now based in Belgium).

“We had funds to spare and we decided that if we wanted to make more acquisitions, we had to become more organized,” he recalls.

The family established Beretta Holding in Luxembourg in 1995, simplifying the firm’s complicated structure, built over centuries, and consolidating ownership under one holding company. That’s around when expansion began in earnest. Beretta picked up Finnish rifle maker SAKO in 2000, its first move outside of shotguns and pistols, and added optics firms Burris and Steiner in 2002 and 2008, respectively, which make scopes, red dots and binoculars. After buying British luxury clothing and handmade gun maker Holland & Holland in 2021 and Ammotec a year later, Beretta Holding now owns 19 brands operating in 23 countries on five continents. Thanks to that push, none of Beretta’s subsidiaries account for more than 25% of the group’s revenues.

“You’ll continue to see more consolidation in the space as people coalesce around known entities,” says Lake Street’s Smith, pointing to the loyalty commanded by Beretta and its subsidiaries among their longtime customers, even after the firms are acquired. “You know what you’re getting with Beretta.”

Prague-based Colt CZ, which bought the American company behind Coltguns in 2021, purchased ammo maker Sellier & Bellot last May for $700million.

For Pietro, the family’s control and deep involvement—his father, whostepped down from executive positions in 2015, sits on the board, whilehis brother Franco runs Fabbrica d’Armi Pietro Beretta, the originalfamily company and now a Beretta subsidiary where Franco’s son Carloalso works—is what sets Beretta apart from its competition.

“We have something that others don’t, and that they’ll never have: asingle family owner,” he says, noting how other storied firearms familiessold out or took their firms public. “When we need to deal with foreigngovernments, it’s me or my brother meeting the president. That’s notthe case with other businesses. We have a long-term vision that isn’tspeculative.”

To keep ahead of its rivals, the Berettas are also reinvesting dividendsand setting aside a portion of revenues to develop new products andproduce guns and ammo more efficiently.

Nowhere is that more evident than at the 240,000-square-foot factoryin central Italy of Benelli Armi, a Beretta subsidiary that makessemiautomatic shotguns. Thanks to investments first made in 2019,autonomous vehicles deliver components to workers on the assemblylines, while screens overhead track their minute-by-minute progress—updated in real-time. Robotic arms test each component for qualitycontrol, using machine learning to improve their performance bydetecting any defects early in production.

“The Berettas aren’t interested in opportunistic approaches.They have a perspective of 25 to 50 years,” explains Matthias Vogel, avice president at RWS.

As Beretta looks toward its 500th anniversary in 2026, Pietro ispragmatic. Asked about his hopes for Beretta’s next half-millennium, hescoffs. “How am I supposed to know how the next 500 years are going togo? I won’t be around, so I don’t really care,” he says. “The nextgenerations will do what is best. I prefer to think about the next fiveyears.”

Credits

Text: Giacomo Tognini

Source: Forbes How This 16th Century Gunmaker Keeps Reinventing Itself